Reducing Insurance Premiums Strategies for Manufacturers

In the intricate web of manufacturing operations, insurance emerges as a silent sentinel, helping to safeguard against unforeseen financial demands. The role of insurance in helping to cover manufacturing overhead cannot be overstated. It can act as a buffer, absorbing the shocks of operational hiccups that could otherwise derail production schedules and inflate costs.

What Insurance Coverage Do Manufacturers Need?

Manufacturers may want to consider the following coverage:

- General liability insurance—Manufacturing processes are prone to accidents, which can result in liability claims. If a third party is injured or has their property damaged due to business operations, general liability insurance may help cover the situation. Additionally, product liability insurance, often a component of general liability insurance, can help financially protect manufacturers if a product defect causes harm by helping to cover legal fees and settlements.

- Commercial property insurance—Natural disasters or accidents can damage facilities and equipment. Property insurance can help manufacturers recover from such losses, helping to ensure that an incident doesn’t lead to financial ruin.

- Business interruption insurance—Should an unforeseen event force a manufacturing plant to pause operations, business interruption insurance can help cover lost income and help pay ongoing expenses until normal operations resume.

- Workers’ compensation insurance—Employees are the backbone of any manufacturing operation. Workers’ compensation insurance is essential for helping to cover medical expenses and lost wages if an employee is injured on the job.

- Equipment breakdown insurance—This coverage can offer financial protection against losses resulting from the sudden and accidental breakdown of various types of equipment and machinery.

How Can Manufacturers Lower Insurance Premiums?

The following strategies may help manufacturers lower their insurance premiums:

- Safety focus—Implement safety protocols to reduce accidents and claims. A safer workplace may translate to lower premiums.

- Risk analysis—Regularly assess risks and trends within your organization. Identifying patterns can allow you to address potential issues proactively.

- Higher deductibles—Choose a higher deductible to lower premium costs. However, be prepared to cover more significant out-of-pocket expenses in case of a claim.

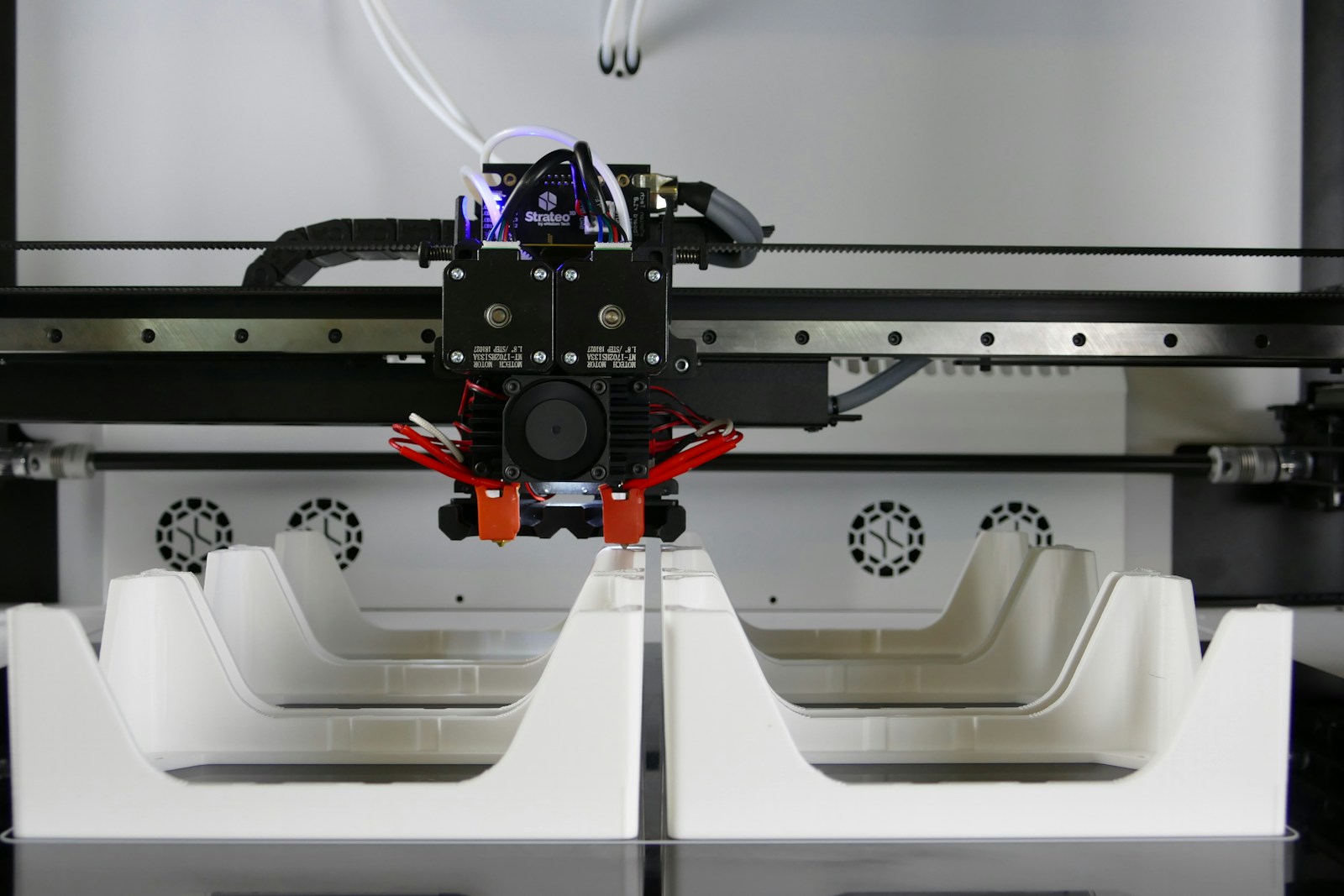

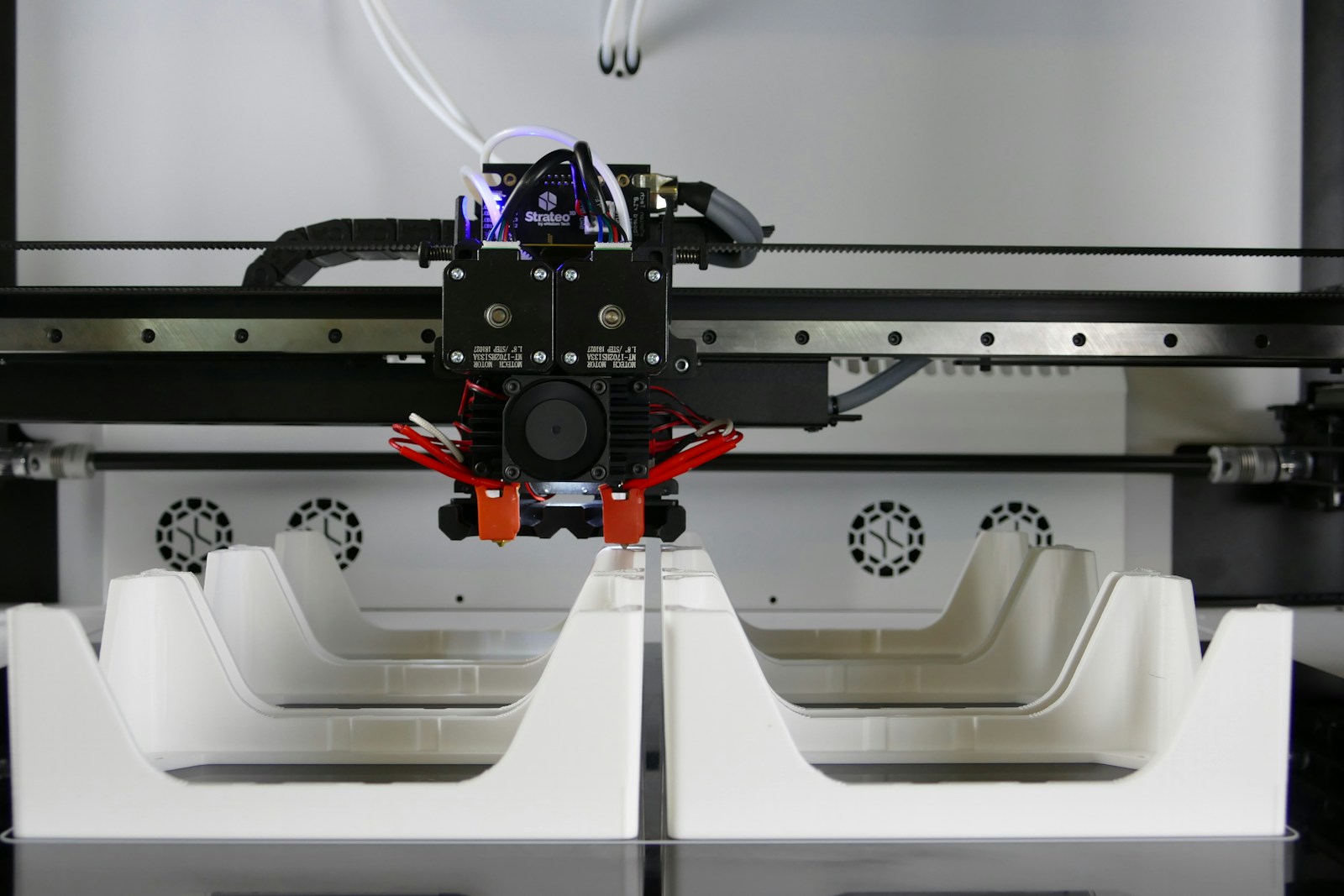

- Technology adoption—Embrace technology to enhance safety, monitor risks and streamline processes. Insurers often reward tech-savvy businesses with lower premiums.

Insurance for Manufacturers in Palatine, IL

Contact Pitcher Insurance Agency to discuss insurance for your manufacturing company. We can make policy recommendations for your operations. If you already have a policy, we can review it and recommend ways you can save.

This blog is intended for informational and educational use only. It is not exhaustive and should not be construed as legal advice. Please contact your insurance professional for further information.

Categories: Blog